99¢ ONLY STORES

NOTICE OF 20102011 ANNUAL MEETING OF SHAREHOLDERS

| TIME AND DATE | 9:30 a.m. Pacific Time on |

| PLACE | City of Commerce Community Center |

| Rosewood Park Meeting Room |

| 5600 Harbor Street |

| City of Commerce, California 90040 |

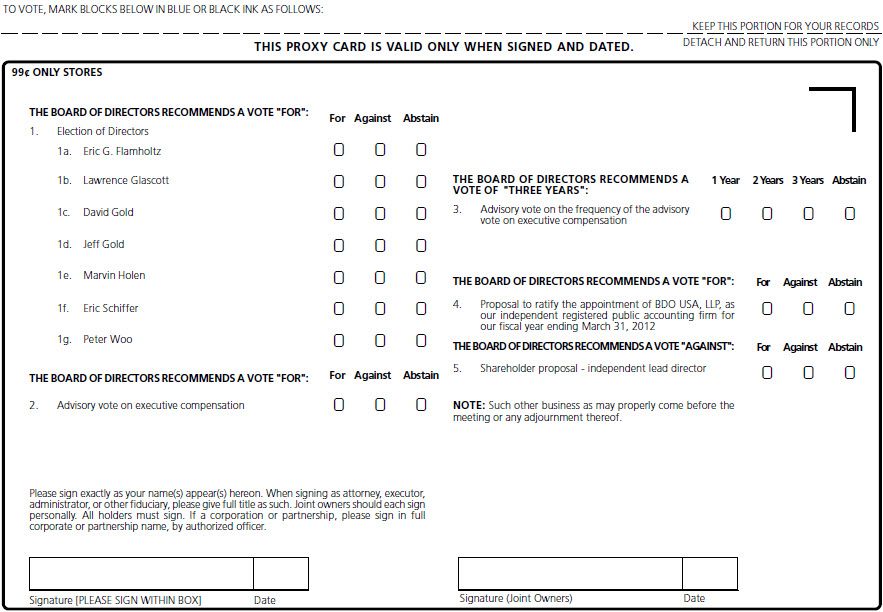

| ITEMS OF BUSINESS | (1) To elect a Board of seven directors, each to hold office until the next annual meeting of shareholders and until his successor is elected. |

| (2) To vote, on an advisory basis, on executive compensation. |

| (3) To vote, on an advisory basis, on the frequency of the advisory vote on executive compensation. |

| (4) To ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for our fiscal year ending |

| RECORD DATE | You can vote at the meeting and at any adjournment or postponement of the meeting if at the close of business on July |

| PROXY VOTING | Please vote as soon as possible, even if you plan to attend the meeting, to ensure that your shares will be represented. All shareholders are cordially invited to attend the annual meeting in person. However, to ensure your representation at the annual meeting, you are urged to complete and return the enclosed proxy if you receive a paper copy or grant a proxy through the Internet at www.proxyvote.com using the instructions included in the notice regarding the Internet availability of proxy materials as promptly as possible. If you receive more than one proxy card because you own shares registered in different names or at different addresses, each card should be completed and returned. |

| INTERNET AVAILABILITY OF MATERIALS | This Notice of |

| By order of the Board of Directors |

| July 27, 2011 | /s/ Eric Schiffer |

| Eric Schiffer |

| Chief Executive Officer |

99¢ ONLY STORES

PROXY STATEMENT

FOR THE 20102011 ANNUAL MEETING OF SHAREHOLDERS ON

September 14, 20107, 2011

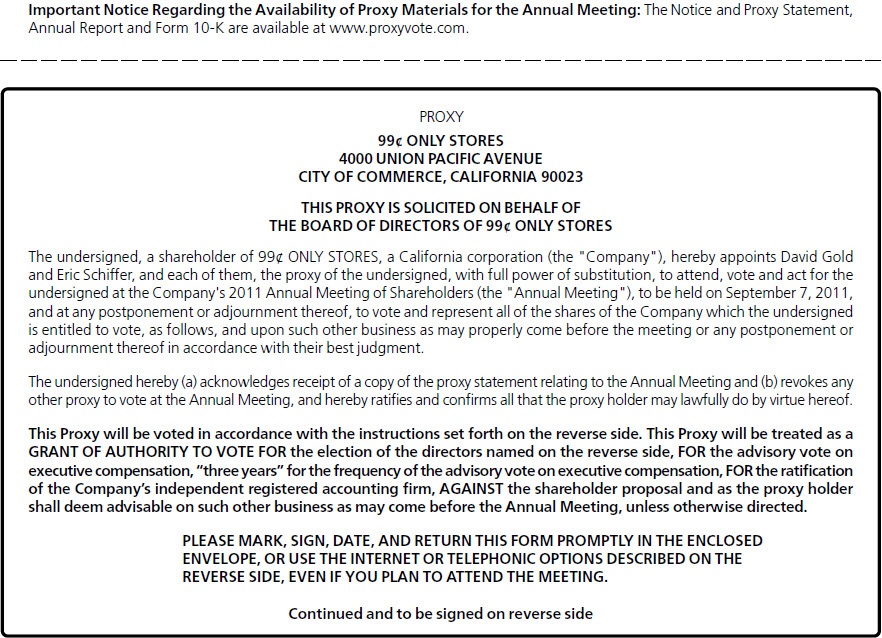

We are furnishing this proxy statement in connection with the solicitation by the Board of Directors (the “Board”) of 99¢ Only Stores (“the Company”), a California corporation, of proxies to be voted at our 20102011 annual meeting of shareholders or at any adjournment or postponement thereof.

You are invited to attend our annual meeting of shareholders on Tuesday,Wednesday, September 14, 2010,7, 2011, beginning at 9:30 a.m. Pacific Time. The meeting will be held at the City of Commerce Community Center, Rosewood Park Meeting Room, 5600 Harbor Street, City of Commerce, California 90040.

The principal executive offices of the Company are located at 4000 Union Pacific Avenue, City of Commerce, California 90023. We anticipate that this proxy statement and the accompanying proxy will be distributed to our shareholders on or about August 5, 2010.July 29, 2011.

Shareholders Entitled to Vote. We have set the close of business on July 19, 201018, 2011 as the record date for determining shareholders entitled to notice of and to vote at the annual meeting and any postponement or adjournment thereof. At the record date, 69,729,87370,532,514 shares of our common stock, no par value, were outstanding. Our common stock is the only outstanding class of securities entitled to vote at the annual meeting. At the record date, we had approximately 12,5259,176 shareholders, which includes 395362 shareholders of record.record.

Proxies. Your vote is important. If your shares are registered in your name, you are a shareholder of record. If your shares are in the name of your broker or financial institution, your shares are held in street name. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting even if you cannot attend. Your submission of the enclosed proxy if you received a paper copy, or a proxy granted through the Internet at www.proxyvote.com using the instructions included in the notice regarding the Internet availability of proxy materials, will not limit your right to vote at the annual meeting if you later decide to attend in person. If your shares are held in a street name, however, you must direct the holder of record as to how to vote your shares, or you must obtain a proxy, executed in your favor, from the holder of record to be able to vote in person at the meeting. If you are a record holder, you may revoke your proxy at any time before the meeting either by filing with our Secretary, at our principal executive offices, a written notice of revocation or a duly executed proxy bearing a later date, or by attending the annual meeting and voting your shares in person. If no instruction is specified on the enclosed proxy (if you received a paper copy) or the proxy granted through the Internet at www.proxyvote.com using the instructions included in the notice regarding the Internet availability of proxy materials with respect to a matter to be acted upon, the shares represented by the proxy will be voted (i) for“FOR” the election as directors of the nominees for director set forth herein (Item 1), (ii) for“FOR” the approval, on an advisory basis, of our executive compensation (Item 2), (iii) to hold the advisory vote on executive compensation every three years (Item 3), (iv) “FOR” the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for our fiscal year ending April 2, 2011, (iii) for the approval of the 99¢ Only Stores 2010 Equity Incentive Plan, (iv) againstMarch 31, 2012 (Item 4), (v) “AGAINST” the shareholder proposal set forth herein, if properly presented (Item 5) and (v)(vi) if any other business is properly presented at the annual meeting, in accordance with the best judgment of the proxy holders.

Voting. You are entitled to cast one vote for each share held of record on the record date on all matters to be considered at the annual meeting.

Quorum. For shareholders to take action at the annual meeting, a majority of the shares of our common stock outstanding on the record date must be present or represented at the annual meeting. Abstentions and “broker non-votes” are counted for this purpose.

Broker Non-votes. A “broker non-vote” arises when a broker does not receive instructions from a beneficial owner and does not have the discretionary authority to vote on an item. For this annual meeting, we understand that brokers have discretionary authority to vote only on the proposal to ratify the appointment of our independent registered public accounting firm.

1

Director Voting Notice. In the past, brokers had discretionary authority to vote in the election of directors if they did not receive instructions from a beneficial holder. Due to a New York Stock Exchange (“NYSE”) rule change, brokers do not have this discretionary authority effective January 1, 2010. Accordingly, if you are a beneficial owner, you must instruct your broker on how you want your shares to be voted in the election of directors in order for your shares to be counted in the election.

Say-on-Pay Voting Notice. Due to aNYSE rule amendment, brokers do not have discretionary authority with respect to any matter related to executive compensation. Accordingly, if you are a beneficial owner, you must instruct your broker on how you want your shares to be voted for executive compensation related matters in order for your shares to be counted in the election.

Vote Required to Adopt or Approval Proposals.

Election of Directors. Per our bylaws, to be elected, each director nominee in an uncontested election must receive a majority of votes cast in favor (i.e., the votes cast for a nominee’s election must exceed the votes cast against the nominee’s election). Shares that are not present or represented at the annual meeting and abstentions will not affect the election outcome. This election is an uncontested election.

Advisory vote on executive compensation. The vote on our executive compensation is advisory and, therefore, not binding on 99¢ Only Stores, the Company’s Board of Directors, or its Compensation Committee. The compensation of our named executive officers will be approved, on an advisory basis, if the votes cast for the proposal exceed the votes cast against it. You may vote in favor or against this proposal, or you may elect to abstain from voting your shares.

Advisory vote on frequency of the advisory vote on executive compensation. For the vote on the frequency of future advisory votes on our executive compensation, the option of one year, two years or three years that receives the highest number of votes cast by shareholders will be the frequency that has been selected by shareholders. However, because this vote is advisory and not binding on 99¢ Only Stores or the Company’s Board of Directors in any way, the Board of Directors may decide that it is in the best interest of our shareholders and the Company to hold such advisory votes more or less frequently than the option selected by the shareholders. You may vote by choosing the option of one year, two years, three years or abstain from voting when you vote on this proposal.

Other Proposals. Approval of each of the other proposals requires the affirmative vote of a majority of the shares present or represented, and entitled to vote thereon, at the annual meeting. Abstentions will have the same effect as an “against” vote. Broker non-votes will affect only the proposal to approve the 99¢ Only Stores 2010 Equity Incentive Plan, where they will have the same effect as an “against” vote if the total votes cast on the proposal do not exceed 50% of our outstanding shares.

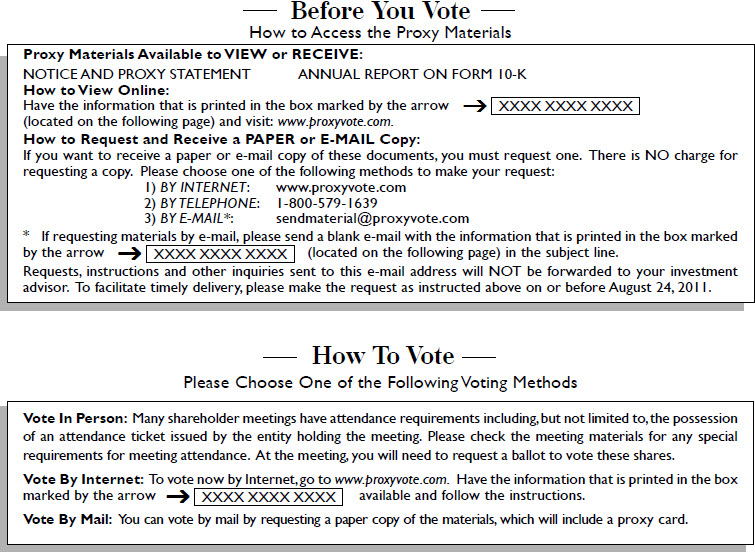

Internet Availability of Proxy Statement and 20102011 Annual Report. The accompanying Notice of 20102011 Annual Meeting of Shareholders, this Proxy Statement, the Annual Report on Form 10-K for the fiscal year ended March 27, 2010April 2, 2011 and a sample proxy card may be viewed, printed or downloaded from www.proxyvote.com.

| ITEM 1: ELECTION OF DIRECTORS |

Item 1 is the election of seven members of the Board of Directors. In accordance with our bylaws, our directors are elected at each annual meeting and hold office until the next annual meeting and until their successors are elected and qualified. Our bylaws provide that the Board of Directors shall consist of no less than seven and no more than eleven directors as determined from time to time by the Board of Directors. The Board of Directors currently consists of seven directors.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below. If any nominee is unable or unwilling to serve as a director at the time of the annual meeting or any adjournment thereof, the proxies will be voted for such other nominee(s) as shall be designated by the current Board of Directors to fill any vacancy. We have no reason to believe that any nominees will be unable or unwilling to serve if elected as a director. If an incumbent director fails to win re-election to the Board in this election, then, unless the incumbent director has earlier resigned, his term will end on the date that is the earlier of ninety (90) days after the date on which the voting results are determined under California law or the date on which the Board selects a person to fill h ishis office.

2

The Board of Directors proposes the election of the following nominees as directors:

| Eric Flamholtz | Marvin Holen |

| Lawrence Glascott | Eric Schiffer |

| David Gold | Peter Woo |

| Jeff Gold | |

If elected, each of the nominees is expected to serve until the 20112012 annual meeting of shareholders and thereafter until his successor is duly elected and qualified.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION TO THE BOARD OF EACH OF THE ABOVE LISTED NOMINEES, ITEM 1.

| ITEM 2: ADVISORY VOTE ON NAMED EXECUTIVE OFFICERS’ COMPENSATION |

As required by Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company is providing shareholders with an advisory (non-binding) vote on the compensation of our named executive officers (sometimes referred to as “say on pay”). Accordingly, you may vote on the resolution set forth below at the 2011 annual meeting.

As described in the Compensation Discussion and Analysis section of this Proxy Statement, with the exception of Rob Kautz, our Chief Financial Officer, the compensation of our remaining named executive officers has been relatively flat for at least the last five years, and no bonuses or equity-based awards have been paid to them since 1997. We believe that the significant Company share ownership of these individuals serves to motivate and retain them and to align their interests with the long term interests of our shareholders better than any compensation program we might otherwise adopt for their benefit. Please read our Compensation Discussion and Analysis beginning on page 13 and the tables and narrative that follow for additional details about our executive compensation program.

This proposal, commonly known as the “Say-on-Pay” vote, gives our shareholders the opportunity to express their views on the compensation paid to our named executive officers. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices as disclosed in this Proxy Statement. We request that our shareholders indicate their support for the compensation of our named executive officers as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K by approving the following resolution:

“RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of our named executive officers, as disclosed in 99¢ Only Stores’ Proxy Statement for the 2011 Annual Meeting of Shareholders pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, the accompanying compensation tables and the related narrative discussion. ”

The advisory vote on the executive compensation program will be passed if the votes cast “FOR” the proposal exceed the votes cast “AGAINST” it. The vote is advisory and will not be binding upon our Board of Directors. However, the Board of Directors and the Compensation Committee of the Board of Directors (the “Compensation Committee”) value the opinions that our shareholders express in their votes and to the extent there is any significant vote against the proposal, we will consider the shareholders’ concerns in making future executive compensation decisions.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE ABOVE PROPOSAL, ITEM 1.2.

ITEM 3: ADVISORY VOTE ON FREQUENCY OF THE ADVISORY VOTE ON EXECUTIVE COMPENSATION |

As required by Section 14A of the Exchange Act, in addition to providing shareholders with the opportunity to cast an advisory vote on executive compensation, this year the Company is providing shareholders with an advisory vote on whether the advisory vote on executive compensation should be held every one, two or three years.

After careful consideration of the frequency alternatives, the Board has determined that an advisory say on pay vote that occurs once every three years is the most appropriate for the Company and, therefore, the Board recommends that our shareholders vote to hold the say on pay vote once every three years. In determining its recommendation, the Board concluded that holding an advisory vote every three years more closely aligns with our underlying compensation philosophy which focuses executives on consistent long-term growth of the Company and sustainable shareholder value. The three-year frequency will allow shareholders sufficient time to evaluate the Company’s executive compensation program in relation to our long-term performance. A three-year cycle will also provide the Board with adequate time to evaluate the results of the “Say on Pay” vote and implement any necessary executive compensation changes.

The proxy card provides shareholders with the opportunity to choose among four options (holding the vote every one, two or three years, or abstaining) and, therefore, shareholders will not be voting to approve or disapprove the Board’s recommendation.

Shareholders are being asked to vote on the following resolution:

RESOLVED, that the shareholders of the Company determine, on an advisory basis, that the frequency with which the shareholders of the Company shall have an advisory vote on the compensation of the Company’s Named Executive Officers set forth in the Company’s proxy statement is:

Choice 1 – every year;

Choice 2 – every two years;

Choice 3 – every three years; or

Choice 4 – abstain from voting.

This vote is advisory and therefore non-binding. Although the vote is non-binding, the Board of Directors values the opinions of the Company’s shareholders and will take into account the outcome of the vote when establishing the frequency of future Say-on-Pay votes.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR “CHOICE 3 - EVERY THREE YEARS” FOR FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION.

ITEM |

The Audit Committee has appointed BDO USA, LLP (“BDO”) as our independent registered public accounting firm to audit our consolidated financial statements for our fiscal year ending March 31, 2012. During fiscal 2011, BDO served as our independent registered public accounting firm. See “Independent Registered Public Accountants” below. Representatives of BDO are expected to attend the annual meeting, be available to respond to appropriate questions and, if they desire, make a statement.

Although not required by our Articles of Incorporation or Bylaws, we are seeking shareholder ratification of BDO as our independent registered public accounting firm. We are doing so because we believe it is a matter of good corporate governance. If BDO’s appointment is not ratified, the Audit Committee will reconsider whether to retain BDO, but still may retain them. Even if the appointment is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in our and our shareholders’ best interests.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE ABOVE PROPOSAL, ITEM 4.

4

ITEM 5: SHAREHOLDER PROPOSAL - INDEPENDENT LEAD DIRECTOR |

John Chevedden has notified us that he intends to present a proposal at the annual meeting. The proposal is set forth below, along with a recommendation of the Board that you vote AGAINST the proposal. We accept no responsibility for the accuracy of the proposal or the proponent’s supporting statement. Mr. Chevedden’s address and share ownership will be provided to shareholders promptly upon a written request to the Corporate Secretary at the Company’s address included in this Proxy Statement, or by calling the Corporate Secretary at (323) 980-8145.

Shareholder Proposal

RESOLVED, Shareholders request that our Board take the steps necessary to adopt a bylaw to require that our company have an independent director (by the standard of the New York Stock Exchange) serve as a Lead Director whenever possible, elected by and from the independent board members and to be expected to normally serve for more than one continuous year.

The bylaw should also specify how to select a new Lead Director if a current Lead Director ceases to be independent.

The merit of this Independent Lead Director proposal should be considered in the context of the need for improvements in our company’s 2011 reported corporate governance status:

The Corporate Library www.thecorporatelibrary.com, an independent investment research firm, said there were ongoing concerns related to our company’s board composition. Five of seven board members had served for at least 14 years, including founder David Gold who served on our board since 1965. On top of that, three long-tenured directors were 76 to 80 years old, signaling possible succession planning concerns. Long-tenured directors can often form relationships that may compromise their independence and therefore hinder their ability to provide effective oversight.

The Corporate Library said the Gold Family—including founder and Chairman David Gold, his wife, Sherry Gold, and their children: President, COO, and director Jeff Gold, EVP and director Howard Gold, and Karen Schiffer, as well as her husband, CEO and director Eric Schiffer—controlled 30% of our company’s total voting power.

Furthermore, despite the fact that our CEO and the Executive Chairman are both controlling family members, our company had not appointed an independent Lead Director. These conditions call into question our board’s ability to act as an effective counterbalance to management.

At our May 2007 annual meeting our CEO, Eric Schiffer, said he talked to 10 director candidates. Thus it appeared that our CEO may have had greater influence in selecting directors than our Nomination Committee.

Three of our 7 directors were insiders—independence concern. Plus non-inside Directors Lawrence Glascott and Marvin Holen received our second and third highest negative votes and together were 50% or 67% of our more import board committees. Not one of our directors served on any other significant board. This could indicate a significant lack of current transferable director experience.

Chief Financial Officer, Robert Kautz earned 5-times as much as each of our next three highest paid executives.

At our annual meetings shareholders should be allowed to ask questions or make statements about the directors, auditors and any management proposal when these items are officially introduced. Polls should remain open throughout the question-and-answer period. Shareowners may find the Q&A session helpful in deciding how to cast a vote.

The above concerns show there is need for improvement. Please encourage our board to respond positively to this proposal: Independent Lead Director—Yes on Item 5.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE AGAINST THE ABOVE PROPOSAL FOR THE FOLLOWING REASONS:

The Board has evaluated this proposal and believes that it is not in the best interests of the Company and its shareholders for this proposal to be adopted.

5

The Board believes that the Company’s governance structure provides the independent leadership and management oversight sought by the proponent. A majority of the Board’s members are independent, and every committee of the Board, other than the Strategic Planning Committee, is composed entirely of independent directors. In addition, under our current governance structure, non-management directors regularly meet for executive sessions, which are presided over by an independent director determined on a rotating basis. These executive sessions are conducted without the presence of management directors or employees of the Company, and allow the independent directors to discuss various matters related to oversight of the Company, the management of the Board’s affairs and the CEO’s performance.

The Board believes that the interests of the shareholders are well served by a board that can adapt its structure to the Company’s changing needs and the capabilities of its directors. We ask our shareholders to recognize the benefits of the Board’s decision to maintain this flexibility and to vote against this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE AGAINST THE ADOPTION OF THE ABOVE PROPOSAL, ITEM 5. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED AGAINST THE ADOPTION OF PROPOSAL NO. 5 UNLESS OTHERWISE SPECIFIED BY THE SHAREHOLDER IN THE PROXY.

6

INFORMATION WITH RESPECT TO NOMINEES AND EXECUTIVE OFFICERS

The following table sets forth information with respect to our directors and executive officers as of June 30, 2011, including a brief summary of each director’s principal occupation, recent professional experience, and certain specific qualifications identified as part of the Board’s determination that each such individual should serve on the Board, and directorships at other public companies for at least the past five years, if any, is provided below:

Directors:

| Name | Age at June 30, 2011 | Year First Elected or Appointed Director | Principal Occupation | |||

David Gold | 79 | 1965 | David Gold has been Chairman of the Board since he co-founded 99¢ Only Stores in 1982 with his wife Sherry Gold. Mr. Gold has over 50 years of retail experience. As the Company’s founder, Mr. Gold brings to the Board vital leadership and executive management skills, extensive retail experience as well as a deep understanding of our business. | |||

Jeff Gold | 43 | 1991 | Jeff Gold joined the Company in 1984 and has served in various managerial capacities. From January 2005 to present, he has served as President and Chief Operating Officer. Mr. Gold has 27 years of experience in the retail industry, including extensive experience in executive management, real estate, store operations, logistics and information technology, among other areas. This background serves as a strong foundation for offering valuable perspectives and expertise to our Board. | |||

Eric Schiffer | 50 | 1991 | Eric Schiffer joined the Company in 1991 and has served in various managerial capacities. In March 2000, he was promoted to President and in January 2005 to Chief Executive Officer. From 1987 to 1991, he was a venture capitalist for Oxford Partners, a venture capital firm. Mr. Schiffer is a graduate of the Harvard Business School. Mr. Schiffer brings to the Board valuable executive retail management experience, as well as financial expertise, among other areas. As a Company director and officer for the past 20 years and President and then Chief Executive Officer for the past 11 years, Mr. Schiffer brings to the Board critical leadership skills and a deep understanding of our business. | |||

Lawrence Glascott | 77 | 1996 | Lawrence Glascott serves on the Company’s Audit (Chairman), Compensation, Nominating and Corporate Governance and Strategic Planning Committees. Mr. Glascott has also served as Chairman of the board of directors of General Finance Corporation (Nasdaq: GFN) since November 2005, and is a member of that board’s audit committee. Before Mr. Glascott retired in 1996, he had been Vice President – Finance of Waste Management International, an environmental services company, since 1991. Prior thereto, Mr. Glascott was a partner at Arthur Andersen LLP and was the Arthur Andersen LLP partner in charge of the 99¢ Only Stores account for six years. Additionally, Mr. Glascott was in charge of the Los Angeles based Arthur Andersen LLP Enterprise Group practice for over 15 years. Mr. Glascott brings to the Board many years of experience in accounting and finance. The Board also benefits from his valuable financial experience as a former partner of Arthur Andersen LLP and his business experience. Mr. Glascott has made significant contributions to the work of our Audit Committee and continues to do so as its Chair. |

7

Marvin Holen | 81 | 1991 | Marvin L. Holen serves on the Company’s Audit, Compensation, Nominating and Corporate Governance (Chairman) and Strategic Planning Committees. He is a practicing attorney and in 1960 founded the law firm of Van Petten & Holen, which specializes in corporate law and finance. As representative examples, Mr. Holen previously served on the board of the Southern California Rapid Transit District (former Chairman), California Blue Shield, United California Savings Bank, Opinion Research of California, California Construction Control Corporation, Los Angeles Theater Center and on numerous other corporate and philanthropic boards of directors. He currently serves on the board of the California Science Center Foundation (former Chairman) and as Chairman of the Board of United Pacific Bank. Mr. Holen brings to the Board his expertise in general business, finance and corporate law. The Board also benefits from his understanding of the Company's institutional history and his extensive and diverse business experience from serving on the board of companies in a wide variety of industries. | |||

Eric G. Flamholtz | 68 | 2004 | Eric G. Flamholtz, Ph.D., serves on the Company’s Compensation and Strategic Planning Committees as Chairman and as a member of Nominating and Corporate Governance Committee. He has been a professor of management at the Anderson Graduate School of Management, University of California at Los Angeles since 1973 and in 2006 became Professor Emeritus. He is President of Management Systems Consulting Corporation, which he founded in 1978. He is the author of several books, including Growing Pains: Transitioning from an Entrepreneurship to a Professionally Managed Firm. As a consultant he has extensive experience with firms ranging from entrepreneurships to Fortune 500 companies, including Starbucks, Navistar, Inc., Baskin Robbins, Jamba Juice and Grocery Outlets, as well as several Chinese companies in various industries. Mr. Flamholtz brings to the Board significant expertise in business management and corporate governance and extensive consulting experience in a variety of businesses. He also has a strong understanding of risk management. | |||

| Peter Woo | 62 | 2007 | Peter Woo serves on the Company’s Audit, Compensation, Nominating and Corporate Governance and Strategic Planning Committees. He is a founder and Chief Executive Officer of Megatoys, Inc., a Los Angeles-based holding company with subsidiaries and facilities in China and Hong Kong. Mr. Woo was instrumental in the redevelopment of the downtown Los Angeles area now known as the “toy district”, and has served as an advisor on international trade to the City of Los Angeles. Mr. Woo brings along over thirty years of experience in international trade, sourcing, retail supply chain logistics and marketing to the organization. |

8

Other Executive Officers: | ||||||

Robert Kautz | 53 | |||||

Howard Gold | 51 | Howard Gold joined the Company in 1982 and has | ||||

Jeff Gold and Howard Gold are the sons of David Gold, and Eric Schiffer is the son-in-law of David Gold.

9

FURTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS |

Independence

The Board of Directors has concluded that the following directors are independent in accordance with the Company's corporate governance guidelines, which are consistent with NYSE listing standards, and it has determined that none of them has a material relationship with the Company which would impair his independence from management or otherwise compromise his ability to act as an independent director: Lawrence Glascott, Marvin Holen, Eric Flamholtz, and Peter Woo.

Board Leadership Structure

The Board is currently comprised of the seven individuals named in Item 1 – four of whom are independent (as defined by the applicable NYSE and Securities and Exchange Commission (“SEC”) rules) and one of whom is our Chief Executive Officer. Under the current structure, the positions of the Chief Executive Officer and Chairman are separate.

We believe that the current structure of the Board provides both independent leadership and the benefits provided by having David Gold also serve as Chairman of the Board. As an individual with more than 50 years of retail experience, Mr. Gold is best positioned to chair regular Board meetings as we discuss key business and strategic issues. Coupled with a procedure for executive sessions of non-management directors whereby a presiding independent director for each session is determined on a rotating basis, this structure provides independent oversight while avoiding unnecessary confusion regarding the Board’s oversight responsibilities and the day-to-day management of our business operations. The Board also believes that Mr. Gold is particularly well-suited to effectively identify strategic priorities, lead the discussion and execution of strategy, and facilitate information flow between management and the Board.

After careful consideration, the Board determined that its current leadership structure is the most appropriate for the Company and its shareholders. As part of the Company’s ongoing commitment to corporate governance, the Board periodically considers its leadership structure to ensure it continues to be in the best interest of the Company and its shareholders.

Meetings and Committees

The Board of Directors held a total of 8 meetings during fiscal 2011. The number of Board committee meetings is set forth below. During fiscal 2011, each incumbent director attended 75 percent or more of the aggregate of (i) the total number of board meetings and (ii) the total number of meetings held by all committees of the Board of Directors on which he served. Directors are encouraged but not required to attend annual meetings of shareholders. All of our directors attended the 2010 annual meeting of shareholders.

The Board of Directors has established an Audit Committee in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee currently consists of Messrs. Glascott (Chairman), Holen and Woo. Each of these directors meets the criteria for independence set forth in the NYSE’s rules and in Rule 10A-3 under the Exchange Act. The Board of Directors has determined that Mr. Glascott is an “audit committee financial expert” as that term is used in Item 407(d)(5) of Regulation S-K promulgated under the Exchange Act. The Audit Committee selects the independent registered public accountants to perform our audit and periodically meets with the independent registered public accountants and our management to review matters relating to our financial statements, accounting principles and system of internal accounting controls, and reports its recommendations as to the approval of our financial statements to the Board of Directors. The Audit Committee also plays a significant role in risk oversight, as discussed below under “Board’s Role in Risk Oversight.” The role and responsibilities of the Audit Committee are more fully set forth in a written charter adopted by the Board of Directors, which is available on our website at www.99only.com. The Audit Committee held 4 meetings during fiscal 2011.

In addition, the Board of Directors has a Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee currently consists of Messrs. Holen (Chairman), Flamholtz, Glascott and Woo. Each of these directors is independent in accordance with NYSE rules. The role of the Nominating and Corporate Governance Committee is to assist the Board of Directors by identifying, evaluating and recommending director nominees and recommending and monitoring corporate governance guidelines applicable to the Company. In identifying director nominees, the Nominating and Corporate Governance Committee looks for independent individuals with business and professional experience, relevant industry knowledge or experience, an ability to read and understand financial statements and other relevant qualifications. Our Nominating and Corporate Governance Committee does not have a policy regarding the consideration of diversity for director nominees; the Committee does, however, give consideration to potential candidates who would represent diversity on the Board with respect to professional background, experience, expertise, age, gender, and ethnicity. Each nominee for election as a director is standing for reelection after being elected by the shareholders at our 2010 annual meeting of shareholders. A shareholder may recommend a director candidate for the Nominating and Corporate Governance Committee’s consideration by submitting a letter to our Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Director Nominee Recommendation.” The letter must identify the author as a shareholder and provide a brief summary of the candidate’s qualifications, as well as contact information for both the candidate and the shareholder. At a minimum, candidates for election to the Board should meet the independence requirements of the NYSE and Rule 10A-3 under the Exchange Act, as well as the criteria identified above. Candidates recommended by shareholders will be evaluated in the same manner as candidates recommended by anyone else. The Nominating and Corporate Governance Committee held 1 meeting during fiscal 2011. A copy of the charter of the Nominating and Corporate Governance Committee is available on our website at www.99only.com.

10

Executive Sessions

The Board has adopted a procedure for executive sessions of non-management directors whereby a presiding independent director for each session is determined on a rotating basis, proceeding in alphabetical order. Interested parties with concerns regarding the Company may contact the non-management directors by sending a letter in care of our Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023; the mailing envelope must contain a clear notation that it is confidential and for the non-management directors.

Compensation of Directors

The Board sets the compensation for each director who is not an officer of or otherwise employed by us (a “non-executive director”) based on recommendations from the Compensation Committee. Our non-executive director compensation package consists of an annual retainer and fees for attending meetings, payable in cash, and an annual grant of stock options. The annual retainer for non-executive directors is $36,000 and board meeting fees are $1,500 for each board meeting attended. Fees for committee members attending committee meetings are $1,000 for each committee meeting attended (provided that fees are reduced to $500 for telephonic committee meetings that last for less than an hour and for committee meetings held on the day of a Board meeting that last less than an hour). The Audit Committee Chairperson receives an annual retainer of $10,000, and the Nominating and Governance Committee Chairperson and Strategy Committee Chairperson receive an annual retainer of $5,000. The Compensation Committee Chairperson receives an annual retainer of $7,500. In addition, each non-executive director receives an annual stock option grant under our equity incentive plan of 9,000 shares, with a per share exercise price equal to the fair market value of our common stock (as determined pursuant to the equity incentive plan).

11

The following table provides information regarding the compensation earned by or awarded to each of our non-executive directors during fiscal 2011:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| (b) | As of April 2, 2011, each non-executive director held options exercisable for the

|

Compensation Committee Interlocks and Insider Participation

During fiscal 2011, the Compensation Committee consisted of Messrs. Flamholtz, Glascott, Holen and Woo. None of these individuals has at any time been an officer or employee of the Company. During fiscal 2011, none of the Company’s executive officers served as a member of the board of directors or compensation committee of any entity for which a member of our Board of Directors or Compensation Committee has served as an executive officer. To our knowledge, there were no other interrelationships involving members of the Compensation Committee or other directors requiring disclosure.

Corporate Governance Guidelines

The Board of Directors has adopted corporate governance guidelines to serve as a flexible framework within which the Board may conduct its business, subject to occasional deviations. A copy of the corporate governance guidelines is available on our website at www.99only.com.

Shareholder Communication with the Board of Directors

Shareholders who wish to communicate with the Board of Directors or a particular director may send a letter to the Corporate Secretary at 4000 Union Pacific Avenue, City of Commerce, California 90023. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Shareholder-Board Communication” or “Shareholder-Director Communication.” All such letters must identify the author as a shareholder and clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The Corporate Secretary will make copies of all such letters and circulate them to the appropriate director or directors.

12

Board’s Role in Risk Oversight

| Name | Fees Earned or Paid in Cash ($) | Option Awards ($)(a)(b) | Total ($) | |||||||||

| Eric Flamholtz | 66,990 | 53,370 | 120,360 | |||||||||

| Lawrence Glascott | 74,246 | 53,370 | 127,616 | |||||||||

| Marvin Holen | 70,242 | 53,370 | 123,612 | |||||||||

| Peter Woo | 65,250 | 53,370 | 118,620 | |||||||||

The Board has delegated its risk oversight responsibilities to the Audit Committee. In accordance with the Audit Committee's charter, the Company's management, including the Chief Executive Officer, President, and other executive officers, meets with and discusses with the Audit Committee the level of risk and controls regarding material risks to our business, among other matters. The Audit Committee also meets at least annually in executive sessions with our Chief Financial Officer, our internal auditors and representatives of our independent registered public accounting firm. The Audit Committee reports to the full Board regarding material risks as deemed appropriate.

CODE OF BUSINESS CONDUCT AND ETHICS |

The Board of Directors has adopted a Code of Business Conduct and Ethics applicable to all of our directors, officers and employees. A copy of the Code of Business Conduct and Ethics is available on our website at www.99only.com.

EXECUTIVE COMPENSATION |

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Objectives

Our compensation program for named executive officers (“executives”) is different than many public company programs. Given the desire of each of Eric Schiffer, our CEO, Jeff Gold, our President and COO, and Howard Gold, our Executive Vice President of Special Projects, to have his compensation unchanged, following the annual review of their compensation by the Compensation Committee, the Compensation Committee did not propose an increase to the compensation of these executives for fiscal 2011 and does not anticipate proposing any material increase in the compensation of these three executives in the foreseeable future. In addition, at the request of each of these executives, the Compensation Committee did not approve any bonuses or equity-based awards for these executives during fiscal 2011. The compensation of each of these executives has been relatively flat for at least the last five years, and no bonuses or equity-based awards have been paid to them since 1997. We believe that the significant Company share ownership of these individuals serves to motivate and retain them and to align their interests with the long term interests of our shareholders better than any compensation program we might otherwise adopt for their benefit. For these three executives, the only material element of their compensation is their base salary.

Our compensation program with respect to our other executives is designed to:

| · | attract, motivate and retain

|

| · | recognize outstanding individual contributions, and |

| · | provide competitive compensation opportunities. |

We provide ongoing income and security in the form of salary and benefits to our other executives that are intended to be both attractive and competitive. We also provide our other executives with short term incentives in the form of an annual cash bonus to build accountability and reward the achievement of annual goals that support our business objectives. A significant part of total compensation opportunity for our other executives is long-term incentive compensation, which promotes retention and provides a link between executive compensation and shareholder value creation over a multi-year period. Our long-term incentive compensation consists of stock options and performance stock units (“PSUs”). The stock options provide compensation tied to the price of our common stock, paid in either cash or stock, and have no value if our common stock falls below the grant price. Our PSUs, which have been a part of our executive compensation program since 2008, are designed to focus executives on achieving improved operating results and delivering value to shareholders. PSUs provide a payout (in shares) to a recipient only if specific earnings goals are achieved.

13

Assessment of Risk

We have reviewed our compensation policies and practices for all employees and concluded that such policies and practices are not reasonably likely to have a material adverse effect on our Company.

Elements of Compensation

Our executive compensation program consists of three main elements:

| · | base salary, |

| · | annual |

| · | long-term incentives. |

We have chosen these primary elements because each supports achievement of one or more of our compensation objectives, and each has an integral role in our total compensation program.

Our Compensation Committee reviews the executive compensation program and specific individual compensation arrangements of executives at least annually. During fiscal 2008, the Compensation Committee retained Watson Wyatt Worldwide as an independent compensation consultant to provide advice and perspective to the Compensation Committee with respect to the Compensation Committee’s review of our long-term compensation program. The Compensation Committee also considered peer data compiled by Watson Wyatt with respect to the long-term incentive practices of a broad set of public company retailers in determining the structure of its long-term incentive program. The Compensation Committee considered this data in obtaining a general understanding of then current trends in such practices and did not use this data for the purpose of benchmarking the compensation of our executive officers against other companies or otherwise in making actual compensation decisions.

Our CEO evaluates each executive and makes recommendations about compensation to the Compensation Committee. The Compensation Committee considers these recommendations but is ultimately responsible, together with the Board, for the approval of all executive compensation arrangements. Our CEO is not present during the Committee’s deliberations about his own compensation.

Base Salary. Base salaries are negotiated at the commencement of an executive’s employment with us and the Compensation Committee reviews them annually. Base salaries are designed to reflect the position, duties and responsibilities of each executive, the cost of living in Southern California, and the market for base salaries of similarly situated executives at other companies. Base salaries are generally intended to be at the mid-range of salaries of other public companies with similar size in terms of number of employees and unit volumes, in similar industries, and with similar growth plans, challenges, and profit potential, all in the judgment of our Board members and human resource professionals based on their substantial accumulated experience and knowledge of these matters. The initial salary of Mr. Kautz in fiscal 2007 ($400,000) was based on the competitive market for his position and his compensation at previous employers. Mr. Schiffer also discussed the total compensation package for Mr. Kautz, and each component thereof, and comparative numbers from other companies, with the national executive search firm the Company had retained to fill his position, although this search firm was not retained by the Company to provide such advice. Mr. Schiffer shared the views of this firm with the Compensation Committee. Based on its annual review for fiscal 2008, the Compensation Committee determined that the base salary of Mr. Kautz remained appropriate and no increase was made for that fiscal year.

On September 5, 2008, Mr. Kautz’s salary was increased from $400,000 to $450,000 per year, effective July 9, 2008 in conjunction with the review of his performance from his hiring date, November 14, 2005 through July 9, 2008. Mr. Schiffer recommended this base salary increase, and the Compensation Committee approved it, based primarily on the extent of Mr. Kautz’s continued contributions through several phases in the turnaround of the Company, including (i) remediating delinquent filings and Sarbanes-Oxley material weaknesses, (ii) rebuilding the internal finance and IT organization to reduce outside consultant annual costs from $15 million to less than $4 million while implementing budgetary, product profitability, and planning systems, (iii) partnering with operations executives to develop effective plans for a three year turnaround which culminated in the March 2009 quarter with a year over year earnings before tax increase from -2.8% to 3.1%, and (iv) developing the February 2008 Profit Improvement Plan goals and investor relations communications approach whereby the Company believes it was rewarded for demonstrating measureable progress from a loss position with strengthening shareholder support and rising stock prices. Mr. Kautz’s responsibilities have expanded from the initial narrow focus on financial reporting to broad based planning and large scale project management, which are believed critical to continued long term growth in earnings. In formulating his recommendation to the Compensation Committee, Mr. Schiffer discussed the potential amount of the salary increase with other Company executives and Compensation Committee members. Both in recognition of Mr. Kautz’s strong job performance during his entire tenure at the Company and for filling the dual roles of Chief Financial Officer and Chief Information Officer during the Company’s search for a senior information technology officer during fiscal 2009, the Compensation Committee also approved, in addition to this salary increase, a one-time cash payment of $67,000 for Mr. Kautz in September 2008. Subsequently, an internal candidate was promoted to the position of Senior Vice President and Chief Technology Officer, reporting to Mr. Kautz and assuming most of the duties of a Chief Information Officer. During fiscal 2010 and 2011, Mr. Kautz’ salary remained at $450,000.

14

The base salaries of the other executive officers, Messrs. Eric Schiffer, Jeff Gold, and Howard Gold, were originally set based on their earlier responsibilities and their stock ownership, and have remained unchanged at their request at approximately $120,000 per annum (see further discussion above under “Compensation Objectives”).

Annual Cash Bonuses. All executives are eligible to receive annual incentive bonuses in amounts approved at the discretion of the Compensation Committee and the Board of Directors. Executive bonuses are based on the executive’s position and base compensation level, the performance of the individual executives in achieving specified individual goals, typically related to the short and long term business and financial performance of our Company.

The terms of Mr. Kautz’s employment agreement (which expired in November 2010) provided that he was entitled to an annual bonus of up to 50% of his base salary (or $225,000) based on achievement of goals related to both Company and personal performance. In fiscal 2008, the Compensation Committee approved annual goals for Mr. Kautz specifically related to increased sales, decreased store and distribution/transportation costs, strategic planning, weekly and monthly reporting enhancements, timely SEC filings and the elimination of material weaknesses in our internal control over financial reporting. Mr. Kautz also was assigned monthly goals during the year by the CEO and achieved a majority of both the annual and monthly goals. The Compensation Committee noted that Mr. Kautz has delivered strong performance for the Company throughout his tenure with the Company and received his full bonus in fiscal 2007, but Mr. Kautz mutually agreed with the Company not to receive any cash bonus for performance in fiscal 2008 given the low overall profitability of the Company at that time. In fiscal 2009, the Compensation Committee approved annual goals for Mr. Kautz specifically related to controlling shrinkage including scrap, meeting targets in corporate general and administrative expenses, achieving PCI Level 1 merchant compliance and internal control compliance, and implementing effective weekly monitoring and reporting of certain key performance measures. Subsequent to the end of fiscal 2009, on June 15, 2009, Mr. Kautz received a bonus award of $346,606. This award was recommended by Mr. Schiffer to the Compensation Committee. The primary considerations of Mr. Schiffer in recommending this bonus to the Compensation Committee, and of the Compensation Committee in approving this bonus, were the extent of Mr. Kautz’s continued contributions through several phases in the financial turnaround of the Company from a loss to meet its long term financial goals earlier than expected, and his achievements related to the specific goals set for the year.

In connection with Mr. Kautz’s annual bonus for fiscal 2010, the Compensation Committee approved quantitative annual goals for Company performance at the beginning of fiscal 2010. The quantitative goals were determined by the Compensation Committee as reasonable goals that in the aggregate would achieve an increase in earnings per share that in its judgment would exceed shareholder expectations. The Compensation Committee evaluated Mr. Kautz specifically related to goals for reducing inventory shrinkage to 2.9%, reducing corporate G&A expenses to 3.8%, and increasing income before taxes to 3.8%, all as a percentage of revenues, respectively. Actual performance exceeded the quantitative goals, with shrinkage being reduced to 2.6% versus the goal of 2.9% and versus 3.2% the prior year, corporate G&A being reduced to 3.5% versus the goal of 3.8% and versus 4.2% the prior year, and income before taxes increased to 6.9% versus a goal of 3.8% and versus 1.1% the prior year. The Compensation Committee also established other goals for Mr. Kautz for fiscal 2010 that were not tied to specific quantitative measures, such as implementing store level review processes to measure and focus corrective actions on store performance, eliminating the material weakness in inventory, developing the project portfolio management process in information technology governance to measure usage and returns on technical resources, and developing certain programs to improve return on investment for real estate investments. Subsequent to the end of fiscal 2010, on June 15, 2010, Mr. Kautz received a bonus award of $225,000.

15

In connection with Mr. Kautz’s annual bonus for fiscal 2011, the Compensation Committee approved quantitative annual financial goals for Company performance at the beginning of the year as reasonable goals in its judgment based on the trends and plans of the Company. The Compensation Committee evaluated Mr. Kautz specifically related to goals for increasing income before taxes for fiscal 2011 to $112.2 million and reducing corporate G&A expenses for fiscal 2011 to 3.4% as a percentage of revenues. Actual performance exceeded the quantitative goals, with income before taxes increasing to $118.2 million and with corporate G&A expenses decreasing as a percentage of revenues to 3.2%. In addition to contributing to achievement of Company financial goals, the Compensation Committee approved individual goals for Mr. Kautz to develop new reporting capabilities and set criteria to improve control of investment and returns for store assets and new business developments, continue to develop the retail information technology architecture to support future growth, and maintain compliance with Sarbanes-Oxley and risk management controls. Based on the recommendation of the CEO and approval by the Compensation Committee, in consideration of the strong Company and personal performances for fiscal 2011, Mr. Kautz received a bonus award of $225,000, paid to Mr. Kautz after the end of the fiscal period, on June 20, 2011.

For each of these years, Mr. Kautz’s annual bonus was therefore based on achievement of both qualitative and quantitative goals, as well as personal performance, and the Compensation Committee did not assign particular weight to any of the individual goals it set, nor was meeting each goal a requirement to achieving the CFO’s target bonus. In each year, the Compensation Committee exercised its discretion in evaluating Mr. Kautz’s performance under the qualitative goals that it set, and in assessing Mr. Kautz’s overall performance, to determine his annual bonus.

As in past years, Messrs. Eric Schiffer, Jeff Gold and Howard Gold chose not to receive an annual incentive bonus for fiscal 2011.

Long-Term Incentives

Overview. We historically provided our executives (other than, at their election, Eric Schiffer, Jeff Gold and Howard Gold) with long-term incentive compensation through stock option awards under our stock option plan. Under this plan, the Compensation Committee is authorized to grant any type of award which might involve the issuance of shares of common stock, an option, warrant, convertible security, stock appreciation right or similar right or any other security or benefit with a value derived from the value of our common stock. In fiscal 2008, the Compensation Committee undertook a review, with the assistance of management and Watson Wyatt, of our long-term management incentive compensation program in light of changes in accounting for stock options and resulting changes in competitive practices, as well as a desire to link long-term incentive compensation more closely to our operating results. As a result of this review, in January 2008, the Compensation Committee approved grants of stock options and new PSUs as a long-term, stock-based pay for performance award designed to focus our management on achieving improved operating results and delivering value to shareholders. The stock options and PSUs are subject to vesting requirements, and the PSUs also require continued employment through an attainment date in order to be credited for the EBT attainment, in order to encourage retention. This long term incentive was a replacement for the Company's customary annual stock option grants which had been made in or around May of each year. These grants of PSUs and time-vesting stock options are expected to be the total equity awards for the employees included in these grants through the end of the performance period, March 31, 2012. In order to align management’s interest with that of the shareholders, the PSU design incorporates a philosophy of awarding long term equity incentive compensation based on meeting profitability performance criteria and based on increases in the Company's stock price. With respect to the PSUs included in the Company’s long term incentive program, in January 2008, the Compensation Committee set specific performance levels for earnings before taxes (“EBT”), which was defined as income before taxes after eliminating any income from any sales of real estate assets and adding back calculated interest income foregone due to using cash to buy back common stock. The performance levels governed the earning of the PSUs without discretion over the ensuing four year period, fiscal 2009 through fiscal 2012, and certain vesting periods were also set for certain of those PSUs for two years following attainment of each performance level. The Compensation Committee set the highest level of attainment at $99 million, a goal that was viewed as motivational for our Company due to its name, and which also exceeded the Company’s previous record level of earnings before taxes of $93.5 million five years earlier in 2003. In fiscal 2008, EBT was $288,000 or basically breakeven. Eight performance levels were set, spread between breakeven and $99 million. Consideration was given to the percentages of total PSUs to be earned at each performance level to give heavier weight to the first two levels which required the management to stem the decline in profitability and show initial increases, and for the fifth and sixth levels which represented the levels deemed difficult but likely to be achieved. Under the long term incentive plan, the actual income before taxes performance as reported in the Company’s Reports on Forms 10-Q and 10-K was then measured against the EBT performance levels described above to determine vesting under the plan. No adjustments to income before taxes were made to calculate EBT during the performance period.

16

PSU/Option Grants. In 2008, the Compensation Committee, with input from Watson Wyatt and management, established long-term incentive award values by management level. In establishing these values, the Compensation Committee considered the 2007/2008 Report on Long-Term Incentives; Plans, Policies and Practices, prepared by Watson Wyatt Data Services. Based on the assumption that our salary levels were at the market median level reported, Watson Wyatt utilized this report (together with a regression analysis for the size of our Company) to determine target values for an annual long-term incentive award by salary level. These target values were then multiplied by five, based on the Compensation Committee’s goal of establishing an award that would provide long-term incentive compensation for recipients over the period from March 30, 2008 through March 31, 2012. The Compensation Committee then allocated PSUs and stock options to each recipient based on the applicable five-year target dollar value. The split between PSUs that vest only based on attaining increasing levels of earnings and options that vest over time was determined to provide a significant incentive to achieve increases in earnings as well as a significant incentive to increase the value of shares of our common stock.

On January 11, 2008, the Compensation Committee approved an award of 280,000 PSUs to Mr. Kautz out of a total of 1,598,799 PSUs awarded to officers and other key personnel. The Compensation Committee also approved a grant of 110,678 stock options to Mr. Kautz, with a three year vesting period, out of a total of 614,452 stock options granted to officers and other key personnel. The long term incentive awards are the only equity awards expected to be awarded to each participant through the end of the performance period, March 31, 2012. The crediting of the PSUs is based on achievement of increases in earnings. At their request, no stock option or PSU awards were made to Eric Schiffer, Jeff Gold or Howard Gold.

PSU Structure. The PSUs are eligible for conversion, on a one-for-one basis, to shares of our common stock based on (1) attainment of one or more of eight specified levels of EBT attainment (as defined below) during the performance period (consisting of fiscal years 2008 through 2012), (2) continuous employment with the Company, and (3) certain vesting requirements. During the period beginning on March 30, 2008 and ending on the date we file our annual financial statements for fiscal year 2012, goal attainment is measured on each date we file our quarterly and/or annual financial statements with the SEC (each such date, a “measurement date”). In fiscal 2010, the Company achieved seven performance levels of EBT attainment set by the 2008 PSU Plan. The Company granted an additional 65,000 PSUs and issued 536,000 shares of common stock based on vested PSUs during fiscal 2010. In fiscal 2011, the Company achieved the last level of EBT attainment set by the 2008 PSU Plan. The Company did not grant any additional PSUs during fiscal 2011. There were approximately 0.5 million PSUs outstanding as of April 2, 2011.

EBT attainment means the sum of our earnings before taxes for the four most recent fiscal quarters as calculated pursuant to generally accepted accounting principles and reported in our financial statements, as adjusted to exclude: (1) any gains or losses on sales, exchanges or other dispositions of our real estate interests held as of December 31, 2007, and (2) extraordinary items. If we either repurchase shares of our common stock or pay cash dividends to our shareholders during the performance period, the calculation of EBT attainment will also adjust earnings before taxes to include interest income that would have been earned from short term securities in the amount of the cumulative repurchases or dividends during the performance period. The Committee believed that these were appropriate adjustments so that the earnings calculation reflected our ordinary course operations and not extraordinary events, and so that management would not be disincentivized from recommending share repurchases or cash dividends to the Board in light of the negative effect such events would have on our income from investments. The Compensation Committee retained the right to amend the PSU awards, as long as the amendments do not (without the recipient’s consent) adversely affect the recipient’s rights. This would allow the Compensation Committee to make adjustments to EBT as may be appropriate to maintain fairness and the desired incentive for executive management to attain long term growth in earnings. However, the right to amend the PSU awards did not provide any specific mechanism to authorize the earning or vesting of the PSUs absent the attainment of the performance levels, and no such amendments have been made. Executives participating in the long-term incentive plan benefit by increasing earnings before taxes in order to earn PSUs and, because the PSUs are paid out as a fixed number of shares that was set in February 2008, Executives also benefit from the increase in the stock price during the performance period and any vesting period. PSUs have been credited, in whole, or in part, as follows:

| Performance Level | #1 | #2 | #3 | #4 | #5 | #6 | #7 | #8 | ||||||||||||||||||||||||

| EBT Attainment Required | $ | 18,000,000 | $ | 25,000,000 | $ | 38,000,000 | $ | 50,000,000 | $ | 63,000,000 | $ | 75,000,000 | $ | 87,000,000 | $ | 99,000,000 | ||||||||||||||||

| % of PSUs Credited | 5.0 | % | 10.0 | % | 15.0 | % | 15.0 | % | 15.0 | % | 15.0 | % | 12.5 | % | 12.5 | % |

17

EBT Attainment is measured on each measurement date. Each performance level can only be attained once within the performance period; however, more than one performance level can be attained on a given measurement date. Although some of the credited PSUs would continue to be subject to time-based vesting after the end of the performance period, any PSUs that are not credited based on EBT attainment by the end of the performance period will generally be forfeited.

The other compensation plans available to our named executive officers consist of our compensation deferral plan and our 401(k) plan.

Compensation Deferral Plan. As discussed below under Deferred Compensation, we have a voluntary compensation deferral plan for highly compensated employees. Under this plan, each executive (and other highly compensated employees) may defer up to 80% of his or her base salary each year.

401(k) Plan. All full-time employees are eligible to participate in the Plan after 30 days of service and are eligible to receive matching contributions from the Company after one year of service. The Company matches employee contributions in cash at a rate of 100% of the first 3% of base compensation that an employee contributes, and 50% of the next 2% of base compensation that an employee contributes, with immediate vesting. Our executives are also eligible for these Company matches, subject to regulatory limits on contributions to 401(k) plans.

Omnibus Budget Reconciliation Act Implications for Executive Compensation. Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), places a limit of $1,000,000 on the amount of compensation that may be deducted by the Company in any year with respect to the Chief Executive Officer and each of the Company’s four most highly paid executive officers other than the Chief Executive Officer and the Chief Financial Officer. Certain “performance-based” compensation that has been approved by our shareholders is not subject to the deduction limit. Awards of stock options under our stock option plan are intended to qualify as performance-based compensation not subject to Section 162(m) of the Code. The PSU awards do not qualify as performance-based compensation under Section 162(m) because our stock option plan, under which the PSUs were granted, does not include approved performance measures for such equity awards. In addition, the PSU awards were not granted during the first 90 days of the performance period, as required by Section 162(m). This may limit the deductibility of our executive compensation in future periods. All compensation paid to our executives in fiscal 2009, 2010 and fiscal 2011 was fully deductible.

Post-Termination Arrangements. We have historically evaluated an award of severance benefits to a departing executive on a case by case basis, with no formal plan in which all executives participate. We previously had an employment agreement with Mr. Kautz that provided for certain post-termination arrangements, but that agreement expired in November 2010. We currently do not have any employment agreements with our executives.

Under the terms of each PSU award, including the PSU award granted to Mr. Kautz, if the recipient is terminated for any reason other than death or disability, all PSUs that have not converted to shares shall be forfeited and shall lapse for no consideration. Because the PSU awards are intended to cover four years’ worth of long-term incentive compensation, the Compensation Committee decided to provide some acceleration of crediting and vesting of PSUs upon a change of control. The amount of crediting and vesting decreases over the term of the performance period, based on the rationale that the further the Company is into the performance period, the more management will have had the opportunity to achieve the specified earnings goals. A further description of the crediting and vesting of PSUs upon a change of control is set forth below under “Potential Payments Upon Termination or Change of Control.”

18

COMPENSATION COMMITTEE REPORT

| Performance Level | #1 | #2 | #3 | #4 | #5 | #6 | #7 | #8 | ||||||||||||||||||||||||

| EBT Attainment Required | $ | 18,000,000 | $ | 25,000,000 | $ | 38,000,000 | $ | 50,000,000 | $ | 63,000,000 | $ | 75,000,000 | $ | 87,000,000 | $ | 99,000,000 | ||||||||||||||||

| % of PSUs Credited | 5.0 | % | 10.0 | % | 15.0 | % | 15.0 | % | 15.0 | % | 15.0 | % | 12.5 | % | 12.5 | % |

The Compensation Committee has reviewed and discussed with management the above Compensation Discussion and Analysis. Based on our review and discussions with management, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

| COMPENSATION COMMITTEE | ||

| Eric G. Flamholtz (Chairman) | ||

| Marvin Holen | ||

| Lawrence Glascott | ||

| Peter Woo | ||

19

COMPENSATION TABLES

Summary Compensation Table

The following table sets forth, for the Company’s Chief Executive Officer, Chief Financial Officer and its other two executive officers (the “Named Executive Officers”), information concerning all compensation paid to such individuals for services to the Company in all capacities during the periods indicated.

| Name and Principal Position | Fiscal Year | Salary ($) (a) | Bonus ($) | Stock Awards ($) (e) | Option Awards ($) (f) | All Other Compensation ($) (g) | Total ($) | ||||||||||||||||||||

| Eric Schiffer | 2011 | 122,308 | - | - | - | 5,302 | 127,610 | ||||||||||||||||||||

| Chief Executive | 2010 | 118,802 | - | - | - | 15,791 | 134,593 | ||||||||||||||||||||

| Officer | 2009 | 120,000 | (b) | - | - | - | 5,326 | 125,326 | |||||||||||||||||||

| Robert Kautz | 2011 | 458,654 | 225,000 | - | - | 11,195 | 694,849 | ||||||||||||||||||||

| Chief Financial | 2010 | 450,000 | 225,000 | - | - | 10,672 | 685,672 | ||||||||||||||||||||

| Officer | 2009 | 434,615 | 346,606 | - | - | 77,115 | 858,336 | ||||||||||||||||||||

| Jeff Gold | 2011 | 122,307 | - | - | - | 5,045 | 127,352 | ||||||||||||||||||||

| President and Chief | 2010 | 120,000 | - | - | - | 16,736 | 136,736 | ||||||||||||||||||||

| Operating Officer | 2009 | 120,000 | (c) | - | - | - | 5,150 | 125,150 | |||||||||||||||||||

| Howard Gold | 2011 | 122,307 | - | - | - | 5,455 | 127,762 | ||||||||||||||||||||

| Executive Vice President of | 2010 | 118,764 | - | - | - | 15,680 | 134,444 | ||||||||||||||||||||

| Special Projects | 2009 | 120,000 | (d) | - | - | - | 5,325 | 125,325 | |||||||||||||||||||

| (a) | The |

| Name and Principal Position | Fiscal Year | Salary ($) | Bonus ($) | Stock Awards ($) (d) | Option Awards ($) (e) | All Other Compensation ($) (f) | Total ($) | |||||||||||||||||||

| Eric Schiffer | 2010 | 118,802 | - | - | - | 15,791 | 134,593 | |||||||||||||||||||

| Chief Executive Officer | 2009 | 120,000 | (a) | - | - | - | 5,326 | 125,326 | ||||||||||||||||||

| 2008 | 120,000 | (a) | - | - | - | 5,140 | 125,140 | |||||||||||||||||||

| Robert Kautz | 2010 | 450,000 | 225,000 | - | - | 10,672 | 685,672 | |||||||||||||||||||

| Chief Financial Officer | 2009 | 434,615 | 346,606 | - | - | 77,115 | 858,336 | |||||||||||||||||||

| 2008 | 400,000 | - | - | 368,735 | 7,297 | 776,032 | ||||||||||||||||||||

| Jeff Gold | 2010 | 120,000 | - | - | - | 16,736 | 136,736 | |||||||||||||||||||

| President and | 2009 | 120,000 | (b) | - | - | - | 5,150 | 125,150 | ||||||||||||||||||

| Chief Operating Officer | 2008 | 120,000 | (b) | - | - | - | 4,996 | 124,996 | ||||||||||||||||||

| Howard Gold | 2010 | 118,764 | - | - | - | 15,680 | 134,444 | |||||||||||||||||||

| Executive Vice President | 2009 | 120,000 | (c) | - | - | - | 5,325 | 125,325 | ||||||||||||||||||

| of Special Projects | 2008 | 120,000 | (c) | - | - | - | 5,140 | 125,140 | ||||||||||||||||||

|

| (c) | Includes $65,908 in discretionary contributions made to |

| (d) | Includes $65,908 in discretionary contributions made to |

| (e) | In accordance with SEC regulations, this column is required to set forth the aggregate grant date fair value of stock awards and performance-based stock awards computed in accordance with the provisions of ASC |

| (f) | In accordance with SEC regulations, this column is required to set forth the aggregate grant date fair value of stock options and performance-based stock options computed in accordance with the provisions ASC 718. Amounts shown in this column do not correspond to the actual value that will be realized by a Named Executive Officer. See Note 8 of Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for fiscal 2011 filed with the SEC on May 26, 2011. |

| Name | Executive Contributions in Last Fiscal Year ($) (a) | Registrant Contributions in Last Fiscal Year ($) | Aggregate Earnings in Last Fiscal Year ($) | Aggregate Withdrawals/ Distributions ($) | Aggregate Balance at Last Fiscal Year-End ($) | |||||||||||||||

| Eric Schiffer | - | - | 298,661 | - | 943,912 | |||||||||||||||

| Robert Kautz | - | - | - | - | - | |||||||||||||||

| Jeff Gold | - | - | 283,040 | - | 954,838 | |||||||||||||||

| Howard Gold | - | - | 284,480 | - | 959,678 | |||||||||||||||

| (g) | Other compensation for Mr. Schiffer, Mr. Kautz, Jeff Gold and Howard Gold includes matching contributions under the Company’s 401(k) Plan and life insurance premiums paid by the Company and a one-time cash payment of $67,000 to Mr. Kautz in fiscal 2009. |

20

Deferred Compensation

We have a deferred compensation plan to provide certain key management employees the ability to defer up to 80% of their base compensation and bonuses. The plan is an unfunded nonqualified plan. The deferred amounts and earnings thereon are payable to participants, or designated beneficiaries, at specified future dates, upon retirement or death. We do not make contributions to this plan or guarantee earnings. Funds in the plan are held in a rabbi trust. In accordance with ASC 710-05-8, “Compensation-Deferred Compensation-Rabbi Trust” the assets and liabilities of a rabbi trust must be accounted for as if they are our assets and liabilities. The assets held in the rabbi trust are not available for general corporate purposes. The rabbi trust is subject to creditor claims in the event of insolvency.

The following table shows the compensation that was deferred by each Named Executive Officer during fiscal 2011:

| Name | Executive Contributions in Last Fiscal Year ($) (a) | Registrant Contributions in Last Fiscal Year ($) | Aggregate Earnings in Last Fiscal Year ($) | Aggregate Withdrawals/ Distributions ($) | Aggregate Balance at Last Fiscal Year-End ($) | |||||||||||||||

| Eric Schiffer | - | - | 162,454 | - | 1,106,366 | |||||||||||||||

| Robert Kautz | - | - | - | - | - | |||||||||||||||

| Jeff Gold | - | - | 125,279 | - | 1,080,117 | |||||||||||||||

| Howard Gold | - | - | 125,919 | - | 1,085,597 | |||||||||||||||

| (a) | Reflects amounts reported as compensation earned by Named Executive Officers in the Summary Compensation Table. |

Grants of Plan-Based Awards in Fiscal 2011

No grants of plan-based awards were made to a Named Executive Officer during fiscal 2011.

21

Outstanding Equity Awards at Fiscal Year End Table

The following table sets forth, for each of the Named Executive Officers, information on the current holdings of stock options and stock awards held as of April 2, 2011:

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||